Empowering insurers, governments, and financial institutions with advanced catastrophe risk modeling to understand, quantify, and react to extreme weather events globally.

Experience unmatched reliability and adaptability with KatRisk’s advanced models. Top-tier inputs and comprehensive data layers integrated with cutting-edge modeling technology mean dynamic risk management solutions that keep you ahead of escalating climate volatility.

Your specific requirements and use cases dictate the configuration of the open model software, guaranteeing improved results optimized for you.

Quickly adjust to evolving dynamics using a flexible framework and open-source technology, offering increased transparency.

Experience personalized service that prioritizes your unique challenges and objectives in a tailored best-in-class solution.

Confidently rely on solutions designed with climate change at their core, enhancing data certainty and integrity.

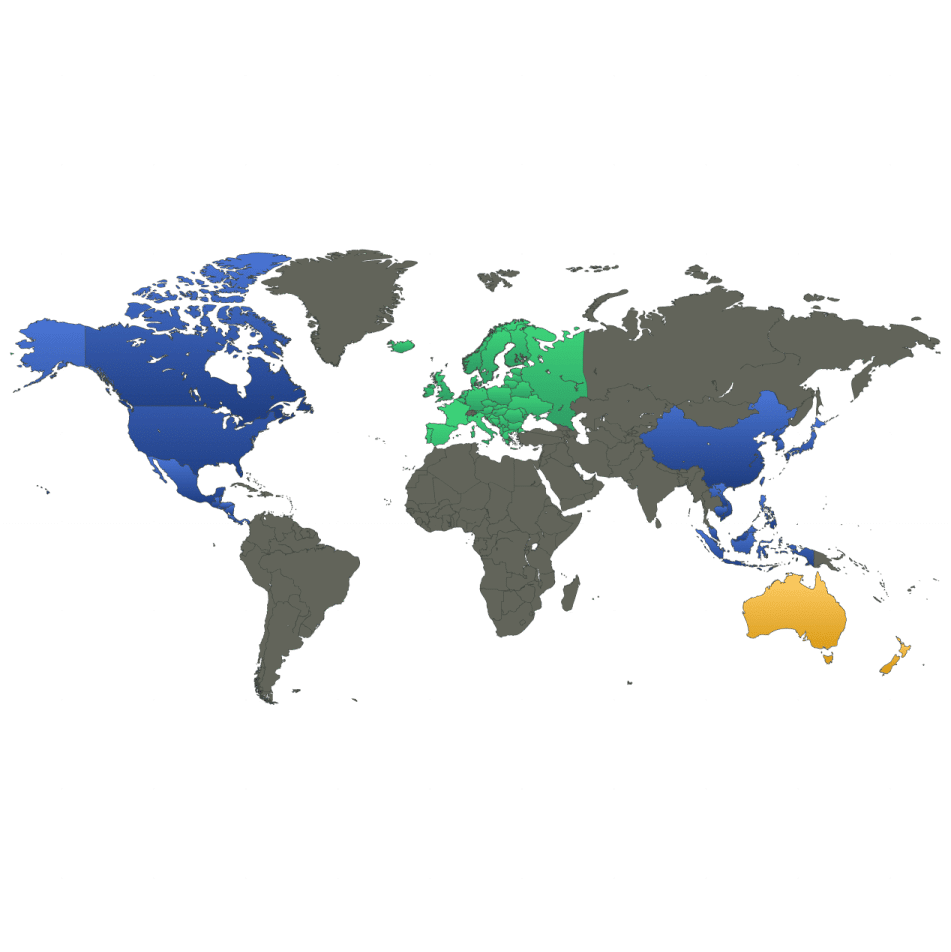

Comprehensive risk assessment with global coverage. Evaluate location, account, and portfolio risks with unparalleled reliability.

Revolutionize your underwriting process with lightning-fast API response times and robust hazard data integration.

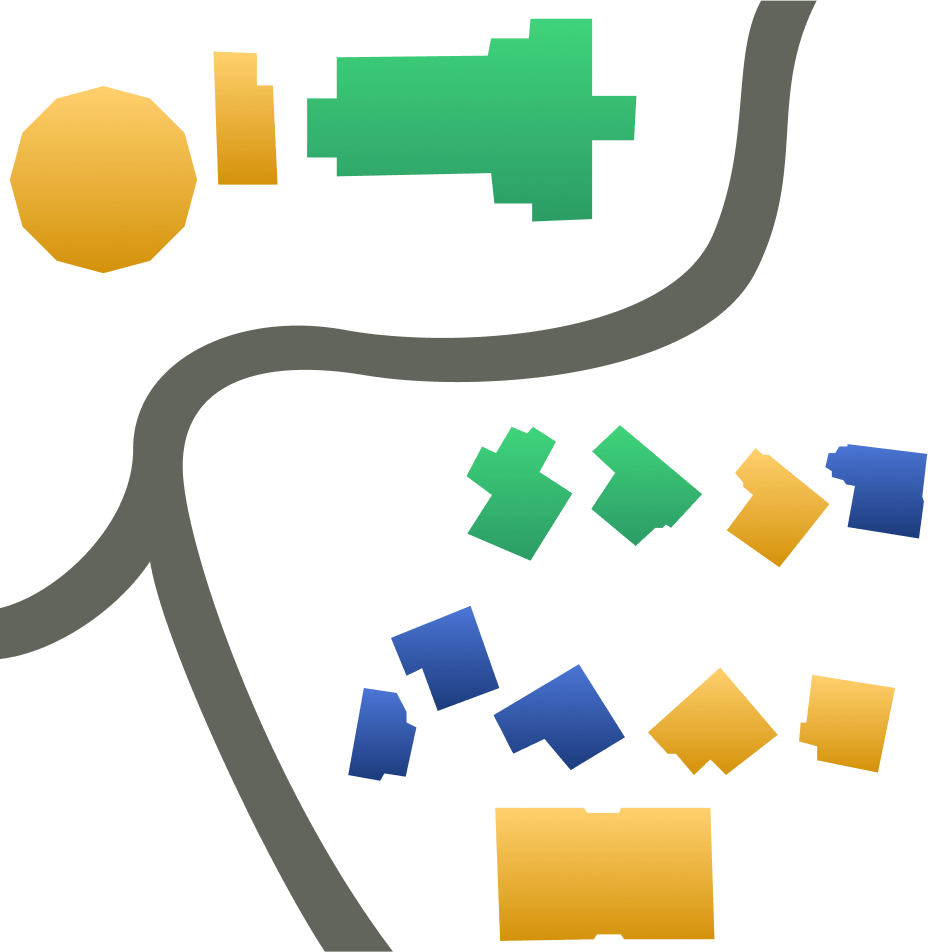

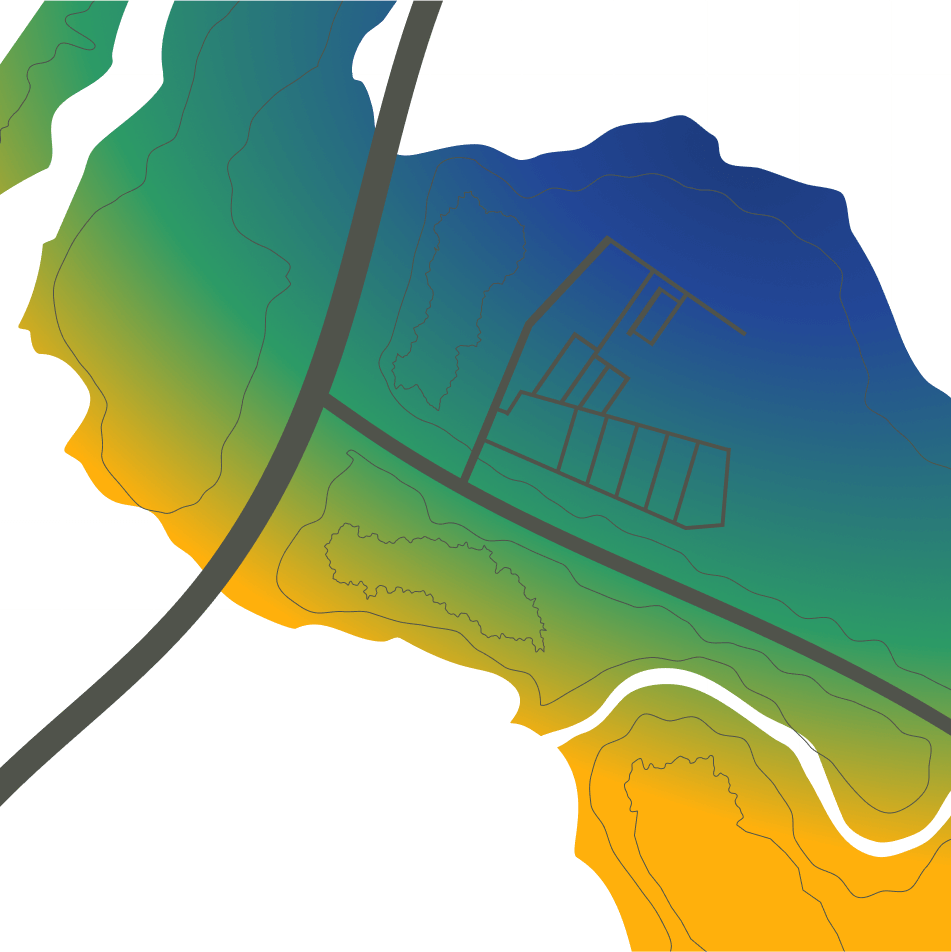

Visualize and analyze catastrophe risks worldwide to better understand location-level risk.

Instant property risk analytics, dynamic visualizations, and seamless reporting, to help insurers and risk managers make decisions with confidence.

High-fidelity probabilistic models for flood, storm surge, tropical cyclone wind, severe convective storm, wildfire, and earthquake.

Rapid event response, hazard data, and loss analytics.

Powerful one-time catastrophe risk modeling calculations and analytics.

Seamlessly access the right data and tools whenever you need them.

Experience speeds 30x faster than the industry standard.

Benefit from global models with industry-leading resolution.

Our robust inland flood model utilizes physical hydraulic and hydrodynamic models with 10-meter resolution data in the US, Europe, and Australia. Our probabilistic models also incorporate storm tracks spanning 50,000 years enabling our clients to better own their view of risk.

KatRisk's storm surge model uses best-in-class inputs and incorporates tropical cyclone tracks spanning 50,000 years for reliable analyses at 10-meter resolution.

Our global tropical cyclone wind model computes wind fields and informs storm surge and flood models, incorporating key track information and overland roughness impacts for hazard assessment at 1km resolution.

KatRisk's severe convective storm (SCS) model revolutionizes the understanding and management of severe weather risks. Hail and straight-line wind are meticulously modeled at a 1-km resolution and tornado at 100-m, offering unprecedented resolution. The model is also highly customizable allowing clients to fully tailor vulnerability factors.

KatRisk's wildfire model modifies probabilities based on recent wildfires and overlays current fuel data to offer precise hazard assessments with a focus on climate change impact and is calibrated against USDA findings.

In progress.

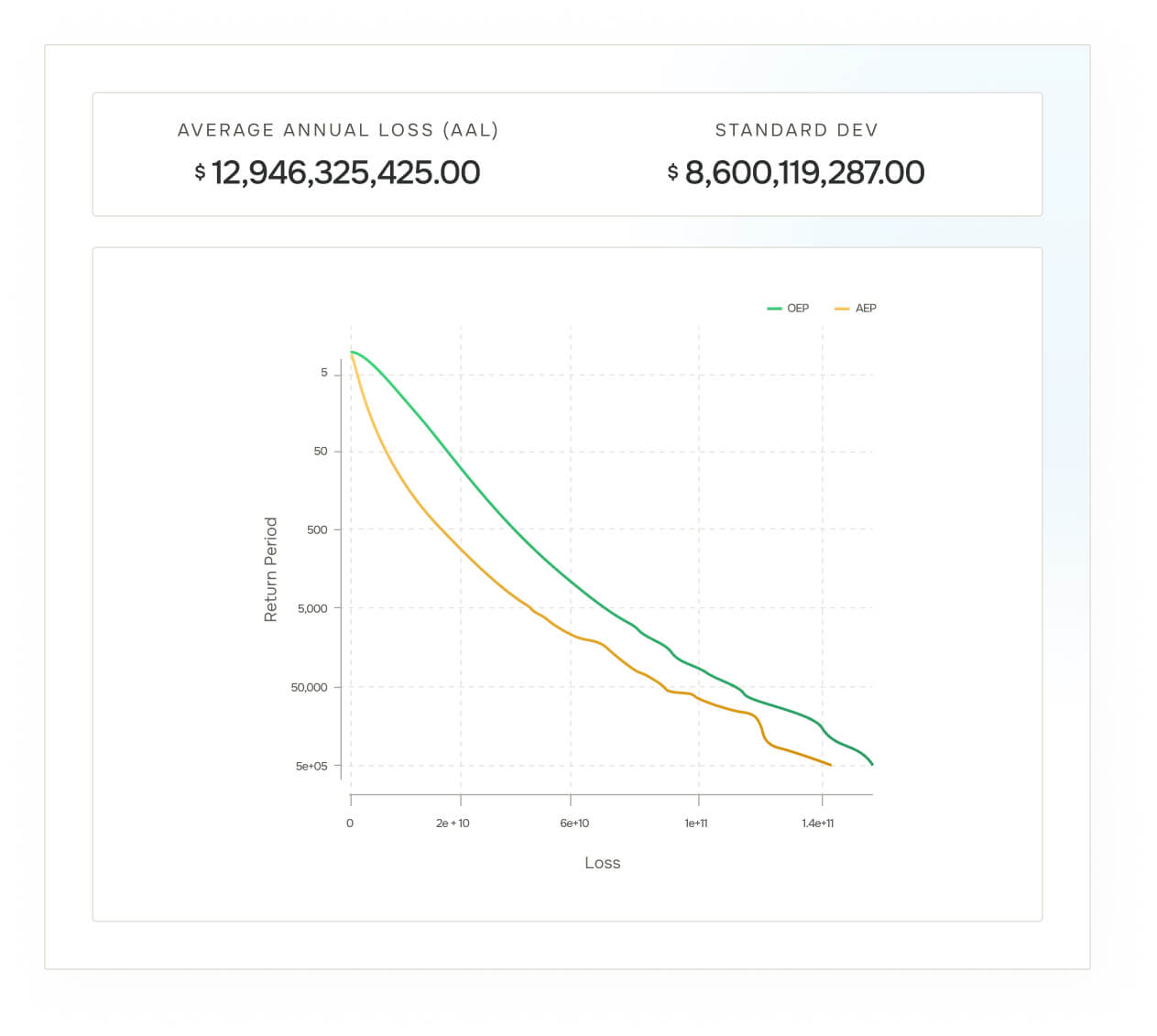

Probabilistic models provide a detailed spectrum of potential future scenarios, not just the most likely outcomes. These models help organizations prepare for and mitigate risks by quantifying and visualizing the probabilities and financial impacts of potentially catastrophic events. While hazard data and location loss analysis tools allow one to quantify risk for a single location, a full event-based probabilistic model provides portfolio-level insights that highlight correlation across multiple locations and regions. Additionally, probabilistic models allow the user to compute losses on any portfolio of business regardless if a historical event has impacted a given area. Providing this level of insight is critical to managing and placing risk, allowing for more robust risk management and informed decision-making without relying solely on historical data.

Catastrophe models transform theoretical but realistic disaster scenarios into actionable insights by providing key metrics such as Exceedance Probability (EP) curves, Return Period Loss, Annual Average Loss (AAL), Tail Value at Risk (TVAR), marginal impact, and Coefficient of Variation (CV). These metrics help understand the potential impact, frequency, and variability of losses, enabling better risk assessment and strategic planning.

A catastrophe model’s reliability is assessed through its ability to reflect historical losses and predict future outcomes. Discrepancies between models should be evaluated by analyzing the assumptions, data inputs, and methodologies used in each model. Diverse model perspectives can provide a more comprehensive risk assessment.

A superior catastrophe model enhances risk assessment capabilities, leading to better-informed financial planning, optimized insurance coverage, and improved compliance with regulatory requirements. For businesses, this translates to reduced financial volatility, enhanced resilience to disasters, and more competitive insurance premiums through more accurate risk pricing.

There are a variety of applications for catastrophe models. Use cases we see often are:

KatRisk’s models stand out due to our integration of advanced data analytics, a detailed financial loss engine, high-resolution modeling capabilities, and consideration of climate variability effects. Our models are designed to provide more reliable, actionable insights that are adaptable to a range of climate scenarios and geographic specifics. They are also distinguished by their transparency and customization options, built with climate change considerations and climate variability enabled, ensuring they remain relevant and effective under changing conditions.